Flexible Spending Account (FSA), Health Reimbursement Account (HRA), and Health Savings Account (HSA) can be great cost-savings tools. You can use them to reimburse yourself for eligible dependent care, dental, and health care expenses. However, it’s important to know which expenses can be reimbursed.

All three of these accounts are used to save on taxes and pay for qualified medical, prescription, dental and vision expenses. However, there is a significant differences between them.

In this article, we’ll focus on cranial prosthesis wigs as the main expense. We’ll also discuss which health spending account is best for this type of expense.

Health Care Spending Accounts Explained

If you buy your own insurance, you don’t need to worry about comparing all these accounts. That’s because you’re only eligible for an HSA. On the other hand, employers can offer any of these accounts. And sometimes they offer more than one at the same time.

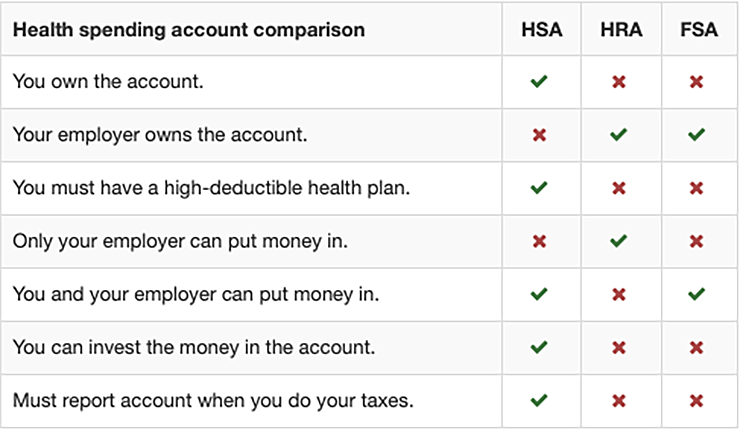

With all of the different acronyms, people are bound to get confused. As it is with most things related to healthcare, nothing is simple. With this in mind, here are the differences between FSA, HRA, and HSA health spending accounts.

So, which health spending account should you get and why would you choose one over the other? Check out the chart below to see how each health spending account compare.

Health Savings Account (HSA)

This type of savings account allows you to set aside money on a pre-tax basis to pay for qualified medical expenses. You can use untaxed dollars in an HSA to pay for deductibles and some other expenses. As such, you may be able to lower your overall health care costs.

You can use the funds in an HSA at any time to pay for qualified medical expenses. But, you can only contribute to an HSA if you have a High Deductible Health Plan.

But the best news is that the cost of your medical wig is eligible for reimbursement using your HSA. To do so, simply obtain a Letter of Medical Necessity from your doctor prior to buying your wig.

Flexible Spending Account (FSA)

Similar to an HSA, you put money into an FSA to pay for certain out-of-pocket health care costs. You don’t pay taxes on the money you contribute. This means you’ll save an amount equal to the taxes you would have paid on the money you set aside.

Albeit your employer can also make contributions to your FSA, they are not required to do so.

Yes, wigs are also covered for reimbursement using your FSA. But ensure you obtain a letter from your doctor stating the wig is medically necessary.

Health Reimbursement Account (HRA)

Employer-funded group health plans like the HRA reimburses employees for qualified medical expenses. However, there is a fixed dollar amount per year. This type of health spending account lets your unused amounts roll over to be used in subsequent years.

Your employer owns this account, not you. Health Reimbursement Account is sometimes called Health Reimbursement Arrangement.

Let’s triple clamp here because your prosthesis wig is also eligible for reimbursement with your HRA. But just like the FSA and the HSA, you must obtain a Letter of Medical Necessity from your doctor.

Conclusion

According to the IRS (yes, another acronym), wigs are indeed eligible for reimbursement. Therefore, you can include in medical expenses the cost of a wig purchased upon the advice of a medical professional. Wigs are necessary for your mental health if you have lost all of your hair from a disease.

Take a look at some of our human hair wigs for sale. You can also visit us to view various types of hairpieces in person and schedule a consult while you’re here.

You can also pay for your cranial hair prosthesis using CareCredit.

You may also enjoy reading: The Definitive Guide On How To Secure A Wig